With the current housing market and the rise in interest rates over the past year, homebuyers are questioning whether they should wait until the predicted interest rate drops.

Mortgage rates have a huge impact on the cost of buying a home, and it’s not surprising that homebuyers have been waiting for the rates to change. However, the interest rate should not be a key deciding factor in the decision about whether to buy a house.

Our mortgage lender, Kristin Ling, answers a few questions she frequently receives about buying a home in today’s market and offers advice on how to handle the current mortgage interest rate.

Q: Are rates high right now?

A: Rates are higher than they were a couple of years ago, but have stayed pretty steady this last year and

it doesn’t sound like they’ll be moving much for a while.

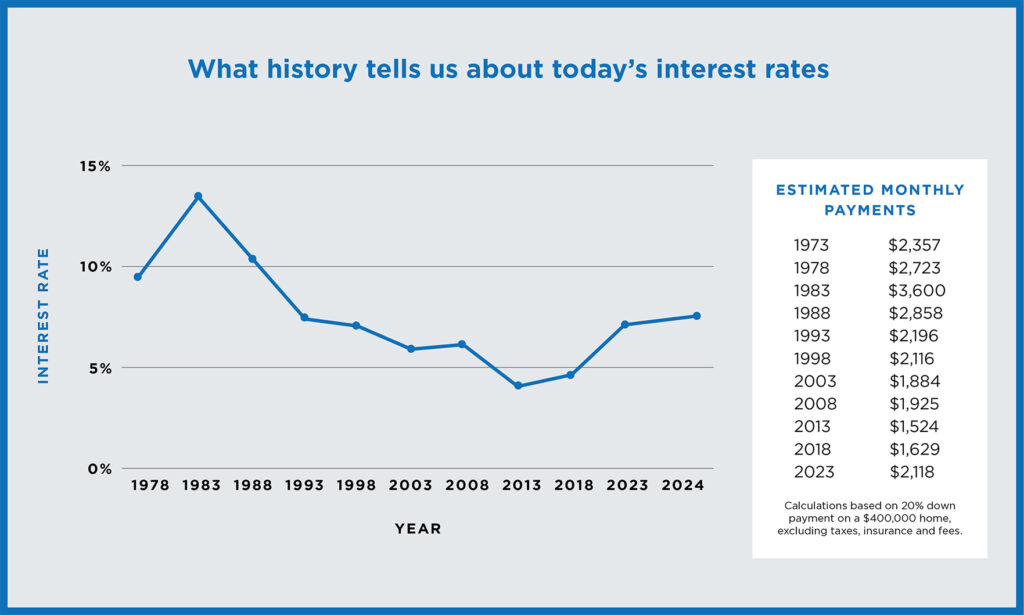

(What history tells us about today’s interest rates – Chicago Agent Magazine)

Q: Should I wait for rates to drop to buy a home?

A: When rates drop, more people will be in the market looking for homes which can drive home prices up. If you can qualify for a home right now, are comfortable with the monthly payment, and find a home that you really want, this may be the time to buy. When rates drop, you can look at refinancing to get the lower rate and payment.

Q: What is refinancing? Is there a time limit on when I can refinance if rates go down?

A: You can refinance at any time- there are no prepayment penalties on a mortgage loan. Refinancing is a whole new loan with the same types of closing costs you incur on a purchase. But it allows you to rewrite your existing mortgage balance into a new lower rate/ lower payment loan.

Q: How can you help me as I prepare to buy a home in 2024?

A: I can help by reviewing your situation- your income, debt, assets etc.- along with what you’re hoping to find, what you have for down payment, and where you want your payment to be, in order to prequalify you for a home loan. We’ll want to continue to touch base with each other during your search process to see if anything has changed in either your scenario or the market to keep the prequalification as current/relevant as possible.