Security & Safety

Guarding your finances. Explore our comprehensive fraud and security resources for financial protection and peace of mind.

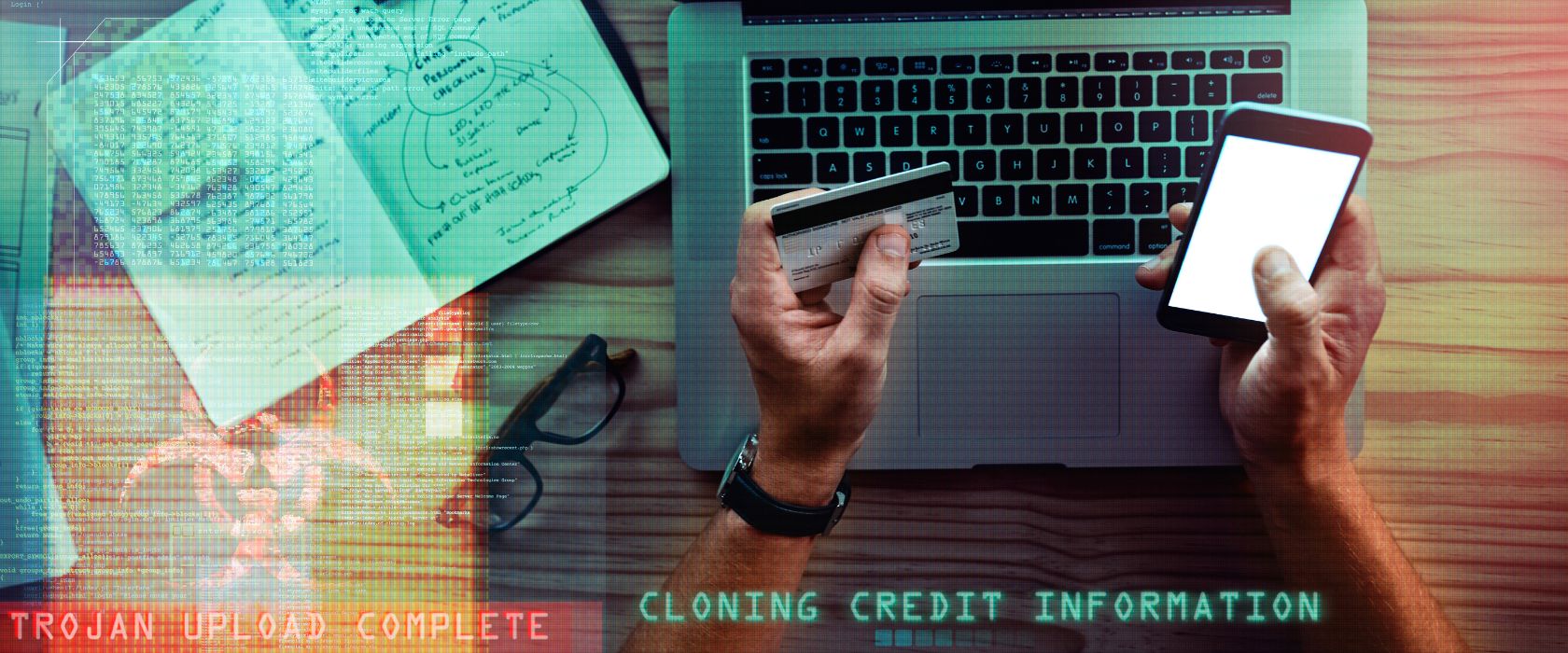

Fraud prevention and security tools are paramount in safeguarding your financial well-being. In an increasingly digital world, the risk of cyberattacks, identity theft, and financial scams is ever-present. These tools provide a critical defense, helping you detect and mitigate potential threats, protecting your assets, personal information, and peace of mind. They empower you to stay ahead of fraudsters, ensuring that your financial resources are preserved, and your financial future remains secure.

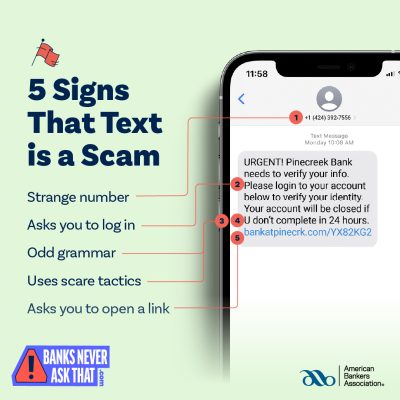

This is NOT us.

Midwest Bank will never ask you to verify information via text message. Do not click on the link! If you have given out your personal information, call your local branch directly.

Quick tips to help you stay safe

These practical tips can help you keep your finances safe and help to protect you against fraud.

-

Log into your online account and review your financial activity daily.

-

Contact your local branch immediately to report any unauthorizes account activity.

-

Keep your cards, checks, and passwords in a secure location.

-

Review your account statements each month.

-

Sign up for real-time account alerts in online banking or the mobile app.

-

Double check email addresses and website links before clicking on them.

-

Be cautious of unsolicited emails, texts, or phone calls. Especially those that ask for personal and/or financial information.

-

Call your local branch to verify any texts, calls, or emails from Midwest Bank if you’re ever in doubt.

Fraud Alerts

Set up account alerts and protect your debit card and accounts. With this technology, we’ll notify you of activity on your account. You can determine the types of alerts you set and how we notify you. Register for notifications by logging into your online banking account and selecting Alerts.

Fraud Prevention Business Webinar

Watch this 30-minute webinar and learn how to prevent fraud and reduce loss for your business.

Learn more about our latest security updates, best practices, and products for businesses to improve fraud prevention.

Have additional questions? Reach out to your local Midwest Bank branch and our team is ready to help you.

Or contact us through our online form and we’ll be in touch.

Fraud Prevention Consumer Seminar

Watch this 30-minute seminar and learn how to prevent fraud and reduce loss for yourself.

Have additional questions? Reach out to your local Midwest Bank branch and our team is ready to help you.

Or contact us through our online form and we’ll be in touch

Helpful Resources

Fraud Protection Blogs

Additional articlesCybersecurity Blogs

Additional Articles

Banks Never Ask That!

Learn more about the American Banking Association’s anti-phishing campaign designed to help protect customers and raise awareness about fraudulent emails, texts, and calls from scammers happening every day around the world. Educate and protect yourself with their tips, videos, and quizzes.

Need help with lost or stolen cards?

To report a lost or stolen debit card:

- During regular business hours, call your local branch

- Outside of regular business hours, call 1-800-472-3272

Fraud Prevention Reminders

Make sure we have your current phone numbers on file – our Fraud Prevention Services will reach out if they suspect suspicious activities on your account.

If you’re traveling internationally, set up your card to ensure it will work overseas. Manage your Cards in MyCards in Online Banking and the Mobile App.

If you get a call from our Card Processing Center, know they are doing their job to prevent potential fraudulent activity of your debit card.

Protect yourself and remember – our Card Processing Center will NEVER ask for:

- Your full card number

- Expiration date on your card

- Your card’s PIN number

- The CVC code on the back of the card

Frequently Asked Questions

What should I do if I see a fraudulent charge on my card?

If you discover a fraudulent charge on your debit card, please call 402-329-4077 immediately. If you are calling outside of regular business hours, please call 1-800-472-3272.

What can I do to protect my identity and account information?

Protecting your accounts and personal information while banking online is crucial to safeguard your financial security. Here are some steps you can take to enhance your online banking security:

- Use a strong, unique password: Create complex passwords that include a combination of letters, numbers, and special characters. Avoid using easily guessable information like your name or birthdate. It’s essential to use different passwords for each online account to prevent a security breach in one account from compromising others.

- Keep your devices secure: Ensure that your computer, smartphone, and other devices used for online banking are protected by strong, up-to-date security software. Regularly update your operating system and applications to patch known vulnerabilities.

- Be cautious with public Wi-Fi: Avoid conducting sensitive online banking transactions while connected to public Wi-Fi networks, as they can be less secure. If you must use public Wi-Fi, consider using a virtual private network (VPN) to encrypt your connection.

- Verify the website’s authenticity: Always access your online banking through the official website or app provided by your financial institution. Double-check the website’s URL to ensure it’s legitimate and look for the padlock icon or “https://” in the address bar to indicate a secure connection.

- Be cautious of phishing attempts: Be wary of unsolicited emails, text messages, or phone calls asking for your personal or financial information. Scammers often use these methods to trick you into revealing sensitive data. When in doubt, contact Midwest Bank directly to verify the request.

By following these security measures, you can significantly reduce the risk of your accounts and personal information being compromised while banking online. Remember that staying vigilant and informed is key to maintaining your online banking security.

What is the padlock icon in my browser?

The padlock icon in your web browser is a symbol that indicates a secure and encrypted connection between your browser and the website you’re visiting. It is typically located in the address bar or the status bar of your browser, depending on the browser you are using. The presence of the padlock icon provides assurance that the website has implemented certain security measures to protect your data during data transfer.